In India, the Institute of Chartered Accountants of India (ICAI) conducts CA exams and certifies a candidate as a qualified Chartered Accountant on successful completion of the three-level course. The Chartered Accountancy course includes examinations that cover the following topics:

- The CA Foundation Examination, formerly referred to as the Common Proficiency Test (CPT), marks the initial stage of the Chartered Accountancy course.

- CA Intermediate (Integrated Professional Competence or IPC) Examination

- CA Final Examination

Institute of Chartered Accountants of India (ICAI) Eligibility Criteria

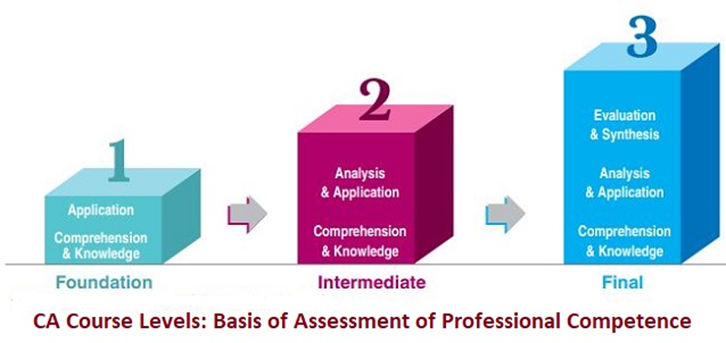

Achieving Chartered Accountant status involves undergoing training and passing exams at different levels, administered by the Institute of Chartered Accountants of India (ICAI), with the main course levels being Foundation, Intermediate, and Final.

Eligibility Criteria for CA Foundation:

- To be eligible for the Foundation examination, candidates must have completed Class 12 and undergone four months of study after CA registration.

- The candidate must register with the Board of Studies.

Eligibility Criteria for CA Direct Entry:

For direct entry to the CA Intermediate course, the candidate must fulfill the following eligibility criteria:

- In this entry route, graduates/postgraduates from the Commerce stream with at least 55 percent aggregate or equivalent score can apply Yet, eligibility requires prior studies in subjects like Accounting, Auditing, Law, Economics, Management, Taxation, Costing, Business Administration, or similar titles.

- Non-commerce graduates/postgraduates need to attain a minimum aggregate of 60 percent or its equivalent grade in examinations conducted by a recognized University, including Open University.

- Direct Route entry is also open to candidates who have passed the intermediate-level examination conducted by The Institute of Cost Accountants of India or by The Institute of Company Secretaries of India. Such candidates are exempted from qualifying Foundation and can register directly for the Intermediate course.

- Candidates in their final year of graduation can also register for the Intermediate course on a provisional basis. Formal registration for these candidates is contingent upon the submission of final year mark sheets or passing certificates within six months of the final year graduation examination, along with the successful completion of ICITSS (Orientation Course and Information Technology). Throughout the provisional registration period, candidates have the option to undergo and fulfill the requirements of ICITSS.

Chartered Accountancy Course and Syllabus

The CA course is divided into three levels:

- CA Foundation,

- CA Intermediate,

- And CA Final Level.

The subjects included at each stage and the marking schemes, officially termed skill assessment, are outlined for education and training across all levels of CA courses.

Syllabus of CA Foundation Course

Comprising four papers, successful completion of all is required to qualify for the CA Foundation course, a fundamental stage in the Chartered Accountancy program. Below is the table indicating subjects and topics included in the four papers of the CA Foundation course:

| PRINCIPLES AND PRACTICE OF ACCOUNTING | |

| Business Laws & Business Correspondence and Reporting | Business Laws |

| Business Correspondence and Reporting | |

| Business Mathematics and Logical Reasoning & Statistics | Business Mathematics and Logical Reasoning |

| Statistics | |

| Business Economics & Business and Commercial Knowledge | Business Economics |

| Business and Commercial Knowledge | |

Syllabus of CA Intermediate Course

The CA Intermediate course consists of two groups, each comprising four papers. Successful qualification at this level of the Chartered Accountancy course requires clearing all eight papers. The table below outlines the subjects and topics covered in these eight papers of the CA Intermediate course:

| CA Intermediate | |

| Accounting | Corporate and other Laws (Company and Other Laws) |

| Cost and Management Accounting | Taxation (Income Tax Law and Indirect Taxes) |

| CA Intermediate Group-2 | |

| Advanced Accounting | Auditing and Assurance |

| Enterprise Information Systems & Strategic Management | Enterprise Information Systems |

| Strategic Management | Financial Management |

| Economics or Finance | Financial Management and Economics for Finance |

Syllabus for CA Final Course

The CA Final course comprises two groups, encompassing a total of eight papers. One has to clear all eight papers to qualify for this level of Chartered Accountancy course. Given below is the table indicating subjects and topics included in the eight papers of the CA Final course.

| Financial Reporting | Strategic Financial Management |

| Advanced Auditing and Professional Ethics | Corporate and Economics Laws |

| CA Final Group-2 Syllabus | |

| Strategic Cost Management and Performance Evaluation | Direct Tax Laws & International Taxation |

| Indirect Tax Laws | Elective Paper |

Institute of Chartered Accountants of India (ICAI) Job Profiles and Salaries

A certified chartered accountant enjoys diverse career prospects and is commonly hired for managing corporate accounting, taxation, and financial accounts, showcasing versatility beyond these responsibilities.

Students interested in exploring potential salaries across various positions can refer to the table for more information.

| Designation | Salary |

| Chartered Accountant | 10 LPA |

| Financial Controller | 15 LPA |

| Tax Accountant | 8 LPA |

| Chief Financial Officer | 6 LPA |

| Auditor | 7 LPA |

| Accounts Clerk | 4 LPA |

Institute of Chartered Accountants of India (ICAI) Top Recruiters

A chartered accountant is necessary for all types of organizations – commercial, private, government, non-government, non-profit, big, small, or even self-employed professionals. Every business that generates revenue needs a chartered accountant to manage its finances and taxes. So, they either hire an independent professional or take the services of chartered accountancy firms.

Here we have mentioned some of the top corporate houses, which hire chartered accountants regularly:

| E&Y | Grant Thorton | Olam International |

| KPMG | BDO | Alghanim Industries |

| Deloitte | RSM International | ETA Ascon Group |

| PwC | Tolaram Group | Landmark Group |

List of Indian firms hiring Chartered Accountants:

Numerous Indian companies provide opportunities for Chartered Accountants to commence their careers, with a selection of these prominent firms outlined in the table below.

| Khumji Khiverji & Co | Lodha & Co | Suresh Surana & Asso LLP |

| SS Kothari Metha & Co | Diwan Chopra & Co | S. Aiyar & Co |

| TR Chadha & Co | Luthra & Luthra | RM Rajapurkar & Co |

| JS Sundaram & Co | ICICI Bank | Axis Bank |

| Federal Bank | Kotak Mahindra | Standard Chartered |

| State Bank of India | HDFC Bank | IDFC Bank |

| RBL Bank | Janalakshmi | Bajaj Finserv & Group |

Steps under CA Foundation Route entry:

The following outlines the entry process for the CA Foundation route when pursuing a Chartered Accountancy course through ICAI.

- Register with the Board of Studies (BoS) after appearing in or clearing the Class 12 examination.

- Complete a four-month study period (bi-annual registration: till June 30/ December 31).

- Appear for the Foundation examination in May/November.

- Qualify CA Foundation course.

- Register with the BoS for the Intermediate course.

- Complete eight months of study course.

- Appear and pass in either or both groups of the Intermediate course.

- Complete a four-week integrated course on Information Technology and Soft Skills (ICITSS) any time after registering for the Intermediate course but before the commencement of the Practical Training.

- Register for three-year practical training on passing either or both the Groups of the CA Intermediate course.

- After clearing both groups of the Intermediate course, candidates can proceed to enroll in the CA Final Course

- Complete Four Weeks Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) during the

last two years of Practical Training but before appearing for the Final Examination - Appear in the Final examination during the last six months of practical training.

- Complete practical training.

- Qualify both groups of the CA Final course.

- Become an ICAI member.

The CA Intermediate under the Direct Entry Scheme involves the following steps:

Given below are the two processes of the Direct Entry route at Intermediate level to pursue a Chartered Accountancy course from ICAI:

Eligible Graduates and Postgraduates:

- Enroll in the Intermediate course by registering with the Board of Studies (BOS). Complete the four-week ICITSS before the commencement of the Practical Training.

- Register for the three-year Practical Training.

- Appear in the CA Intermediate examination after nine months of Practical Training.

- Qualify CA Intermediate level.

- Register for the CA Final Course after qualifying both groups of the Intermediate course.

- Complete four-week AICITSS during the last two years of practical training but before appearing for the CA Final examination.

- Appear in the CA Final examination during the last six months of Practical Training.

- Complete Practical Training.

- Qualify both groups of CA Final.

- Become a member of the Institute of Chartered Accountants of India (ICAI)

Steps under the Direct Entry Scheme for students who have passed Intermediate level examinations of the ICSI or Institute of Chartered Accountants of India

- Register with the BoS for the Intermediate course.

- Complete eight months of study course.

- Candidates can appear for and successfully clear either one or both groups of the CA Intermediate examination.

- Complete the four-week Integrated Course on Information Technology and Soft Skills (ICITSS) at any time after enrolling in the CA Intermediate course but before starting Practical Training.

- Upon successfully passing either or both groups of the Intermediate course, candidates can register for a three-year Practical Training program.

- Upon completing both groups of the Intermediate course, candidates can proceed to register for the CA Final Course

- Complete the four-week Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) within the last two years of Practical Training but before taking the CA Final examination.

- Appear in the CA Final examination during the last six months of Practical Training.

- Complete Practical Training.

- Qualify both groups of CA Final level.

- Become a member of the Institute of Chartered Accountants of India (ICAI) to be eligible to start practice as a certified Chartered Accountant.