Starting a business in India has become easier with the various union government support programs. Among them, the PMEGP scheme (Prime Minister’s Employment Generation Programme) is one of the most powerful initiatives for aspiring entrepreneurs. Whether you are from a rural or urban area, this PMEGP scheme helps you start a micro or small enterprise with financial support, subsidies, and loan assistance.

What is the PMEGP Scheme?

The PMEGP scheme is a credit-linked subsidy program under the Ministry of MSME. It aims to generate self-employment opportunities by providing financial assistance to individuals and groups to start new ventures. The loans are provided through banks, and subsidies are credited by KVIC.

If you are searching for government loans to start business, the PMEGP scheme is one of the most beneficial options available today.

Key Objectives of the PMEGP Scheme

- Promote entrepreneurship in rural and urban India

- Provide government loans to start business ventures

- Support unemployed youth, women, SC/ST/OBC, minorities, and differently-abled individuals

- Encourage traditional and modern small industries

- Generate sustainable employment opportunities

Eligibility Criteria for PMEGP Scheme

To benefit from the PMEGP scheme, you must meet the following conditions:

Individuals

- Minimum age: 18 years

- Education: 8th pass (required for projects above ₹10 lakhs in manufacturing and ₹5 lakhs in service sector)

Groups & Institutions

- Self Help Groups (SHGs)

- Charitable trusts

- Registered societies

- Production cooperative societies

Not Eligible

- Existing businesses

- Units that have already received other subsidies

Maximum Loan Under the PMEGP Scheme

- Manufacturing Projects

- Loan amount: Up to ₹25 lakh

- Service Sector Projects

- Loan amount: Up to ₹10 lakh

PMEGP Subsidy Scheme Details

| Category | Rural Subsidy | Urban Subsidy | Beneficiary Contribution |

| General | 25% | 15% | 10% |

| SC/ST/OBC/Minorities/Women/PH/Ex-Servicemen/NER | 35% | 25% | 5% |

Note: This refers to the subsidy given to applicants who set up their business in rural areas or within urban limits such as towns and municipalities.

Sectors Covered Under the PMEGP Scheme

The PMEGP scheme supports hundreds of activities, including:

- Manufacturing units

- Food processing industries

- Service and trading activities

- Handmade, handicraft, and rural industries

- Agri-based non-farm businesses

If you’re looking for government loans to start business in any of these sectors, this scheme is ideal.

How to Apply for PMEGP Loan Online?

You can easily pmegp loan apply online through the official portal. Follow these steps:

- Visit the official website: https://www.kviconline.gov.in/pmegpeportal

- Click on “Online Application”

- Select Individual or Institution

- Enter Aadhaar, PAN, name, and contact details

- Upload required documents:

1. Aadhaar Card

2. PAN Card

3. Project Report

4. Education Proof

5. Caste Certificate (if applicable)

6. Address Proof - Submit the form

- Application goes to KVIC/DIC/Bank for approval

- The bank processes the loan, and the subsidy is released after the project begins

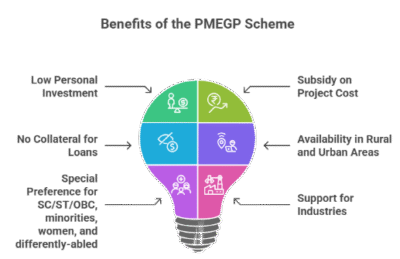

Benefits of the PMEGP Scheme

- Low personal investment (only 5–10%)

- Up to 35% subsidy on project cost

- No collateral for loans up to ₹10 lakh

- Available in both rural and urban areas

- Special preference for SC/ST/OBC, minorities, women, and differently-abled

- Support for traditional and modern industries

If you’re ready to take the next step, explore pmegp loan apply online and turn your idea into reality. The PMEGP scheme can be the beginning of your entrepreneurial journey.